Competitive comparisons serve vendors seeking to learn from the best practices and trappings of their peers, as well as buyers seeking to make the most appropriate software selection decisions

April 2022

Author: Bryan Belanger

April 2022

Author: Bryan Belanger

We founded XaaS Pricing based on decades of experience across hundreds of competitive intelligence (CI) projects. We are third-party CI experts by trade and have mostly served clients that occupy similar roles within large technology companies. Our clients uniformly value competitive intelligence, because if they didn’t, well, they probably wouldn’t be working with us.

So, we, of course, see significant value in CI for the Anything a Service (XaaS) and SaaS spaces broadly as well as specifically related to competitive pricing. Competitive comparisons serve vendors seeking to learn from the best practices and trappings of their peers, as well as buyers seeking to make the most appropriate software selection decisions.

As we continue to expand XaaS Pricing’s data platform, digesting a lot of pricing pages in the process and engaging with the SaaS product community, we have observed that some seem to agree with us: Here’s a post that sums up our stance, as well as the opposing point of view, quite well.

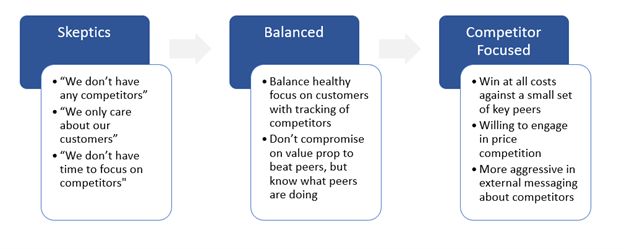

There seems to be three general personas emerging for vendors in the SaaS space, based on how they view the value and utility of CI: skeptics, balanced and competitor focused.

These are admittedly probably an oversimplification, and we haven’t done our survey-driven cluster analysis to formalize this. Maybe we will soon. But we definitely see these dynamics playing out as we gather data for our XaaSPricing Intelligence Platform.

One particular area that has caught our attention from our data collection is the use (or lack thereof) of the “us versus alternatives” page. We believe this is a reliable indicator of where a vendor and/or segment fits into our hypothetical persona model.

As we scanned the Forbes Cloud 100 when building out our very first MVP dataset, we rarely saw vendor websites that directly positioned products and/or pricing against competitors. Competitors were rarely, if ever, mentioned in any context. However, as we’ve expanded our dataset to cover a much broader cohort of vendors across categories, we’ve noticed much more active and varied uses of competitive positioning on marketing sites.

Let’s use the appointment scheduling and calendar management software category to illustrate this point. Market leader Calendly (also a Forbes Cloud 100 vendor) makes no mention of competitors and does not have a comparison page. Calendly is in pole position and is hyperfocused on driving customer usage growth.

However, fast-following peers frequently leverage marketing to position themselves against Calendly. Here’s an example from GReminders, focusing directly on Calendly, and another from Simplybook.me, which includes a competitive comparison against Calendly and a few other peers.

Here’s what we like about these types of pages:

Here’s what we don’t like:

At this stage of the game, we’re busy tearing down and grading your pricing pages via our Grade My Pricing Page service. We haven’t ventured into grading competitive comparison pages just yet. That said, if you have questions about your competitive comparison page and/or want to chat for 15 or 30 minutes to gather our impressions on how you might optimize, reach out via email to schedule a free consult.

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

The lowdown on XaaS pricing changes

The lowdown on XaaS pricing changes