Why should I care about my competitors’ pricing?

You’ve probably read an article or two (or one hundred) about the importance of value-based pricing in establishing a winning SaaS pricing strategy. Those articles are accurate, and you should consume them, embody them, and employ their guidance in practice as liberally as your role, budget, time, resources and culture allow. Value-based pricing is the best way to build a sustainable, effective pricing strategy.

When it comes to competitor-based pricing, those articles usually comprise the same information written in different ways. Competitor-based pricing is usually a footnote in a broader conversation about pricing methodologies and concepts. You’ll see advice such as “competitor-based pricing is better than cost-plus pricing, but not as good as a value-based pricing strategy” and/or “look at competitors’ pricing, but don’t base your strategy on it.”

These are true statements, but they are too general. This type of guidance doesn’t provide a full picture of the importance and value of analyzing your competitors’ pricing strategies. There are rarely breakdowns of when, why or how you should use competitor pricing analysis and benchmarks, and how analyzing competitor pricing strategies can actually be a key part of your value-based pricing strategy.

In this post, we break it down, starting with the most important question: Why should I care about competitors’ pricing? If everything should be oriented to customer value, why care about competitors at all? Wouldn’t I be better served pouring all my efforts into activities that can support value-based pricing, like Van Westendorp surveys?

Two major reasons why you should care

Other people care, and always will care, about competitors’ pricing

In our experience, even if you, your team and/or your boss aren’t focused on competitors when it comes to setting your pricing strategy, there is someone else who is. For that person(s), understanding and clarifying competitor positioning is essential to making an appropriate determination on your firm’s pricing strategy.

An obvious and typical source of competitive intensity is sales; sellers hear about competitors daily and naturally many of these conversations are about relative price positioning of your product(s) versus your competitors. Executives are often also highly attuned to the activities and strategies of competitors, and are keen to learn more about strategy guidance in the context of their peers.

I’ve seen this from all angles. As a consultant observing how multifunctional teams interact and debate over project results, I’ve regularly seen how competitors can rise to the top of strategy discussions. As the person actively delivering research findings and guidance on strategy, I’ve faced this directly as well. I once had a CEO stop me during a presentation that had nothing to do with his firm’s competitors to ask for a full breakdown of how his competitors compared in the topic we were discussing (digital commerce go-to-market models). We spent the entire meeting breaking down the benefits and drawbacks of one particular competitor’s strategy.

Caring about competitors’ pricing strategies can save you time and help you focus

While it may seem counterintuitive, spending the extra time upfront to benchmark and analyze competitors can help you save time in the long run and improve your strategic focus. We’ve seen this materialize in a few different ways.

The first relates to the previous point. You’re likely to be asked for competitive pricing insights at some point, whether it’s by a curious executive in a readout presentation or by an eager rep seeking deal support via a last-minute Slack message. If you’ve done the homework, you can usually address the question quickly and move on to value-based strategy discussions. If you don’t have the competitive insights available, the conversation often spirals into how you “really need to have competitor research,” and you’re often saddled with the action of going and doing the homework anyway.

The second is related to focus. The need for a pricing strategy exercise often coalesces around a partially formed hypothesis based on incomplete, inconsistent and anecdotal data. This hypothesis expands and shape-shifts once it is shared with others in your organization for feedback. With each new set of eyes, the visibility of the need and the magnitude of the competitive research gaps in your team’s data grows. Before you know it, you’re wrangling multiple stakeholders to scope a pricing project.

In practice, the process might go something like this:

- Your VP of sales reaches out to your team via an email or Slack message that reads, “We keep losing deals to Competitor A. Bob just lost another deal to them this morning. Our pricing is way too high to compete and we’re seeing large discounts. What data do we have on this?”

- You reemphasize your firm’s positioning and create some assets, such as case studies, a battle card, some call recordings from Gong and/or a recent profile that was completed on that competitor.

- The VP responds with something like, “Thanks; copying these five people for visibility and comment.”

- The email discourse then expands: “While we’re at it, we should look at Competitors B, C, D, E and F too”; “I heard they are doing a lot of three-year deals, we need to be doing that”; “They are bundling these two products and selling at 50% discounts”; “Can we make sure this is relevant to the global teams too?”

Before you know it, you have several potential stakeholders, with related but different needs, and the magnitude of the ask has grown into a large-scale research project requiring significant primary research and outside vendor support to address.

Requests that start this way often end at a common point, with one or more people saying, “We don’t know what we don’t know. We need to learn everything there is to be learned about our competitors’ pricing strategies.” XaaS Pricing often gets a version of this brought to us, as we’re the third-party consultant that is brought in to support the internal pricing and competitive intelligence teams.

While end-to-end pricing knowledge on your competitors may be an admirable goal, it is not always practical and rarely addresses the true priorities needed to move the ball on your pricing strategy. Studies that aim to solve everything often solve nothing. Approaching an engagement without a firm, singular hypothesis leads to a project that provides a lot of information but with no answer to a central question.

This is where having a proactive approach to competitive pricing research becomes really valuable. If you have already done the research using a holistic and consistent approach, you can quickly confirm and prioritize or refute and eliminate hypotheses that crop up among stakeholders throughout your organization. If someone in your firm says “We really should be focusing on the fact that our trial is too short,” but you have competitive and market data that says 95% of competitors offer a longer trial than you do, you can disprove that hypothesis and instead focus efforts on key unanswered and unvalidated questions.

The key to deploying this approach is beginning with a comprehensive and consistent framework-based approach to competitive research.

What aspects of my competitors’ pricing should I care about?

Over the last decade or so, we’ve done hundreds of custom competitive and market pricing research and advisory projects in the global high-tech sector. We’ve sat through thousands of meetings with decision makers at a cross-section of midsize and large technology vendors. We’ve lived and breathed conversations like those summarized in the previous section.

What we’ve learned is that there are common competitive and market insights that are required foundations of any pricing project. Even if the ultimate goal of a project is to design and implement a value-based pricing study aligned to customer willingness to pay, rather focused on competitors, projects usually begin with a baseline assessment of the pricing and packaging strategies and positions of key competitors and/or adjacent industry players.

At XaaS Pricing our goal is to transmute these project experiences into a comprehensive-but-never-finished metrics taxonomy of the quantitative and qualitative insights that nearly all vendors require in every project.

The idea was to create a platform that could be used to access commonly required competitive pricing insights and build benchmarks quickly and with a consistent framework, allowing vendors to move more easily past internal conjecture and ad-hoc requests, prioritize critical hypotheses efficiently, and spend more time on deeper investigation of true pricing needs.

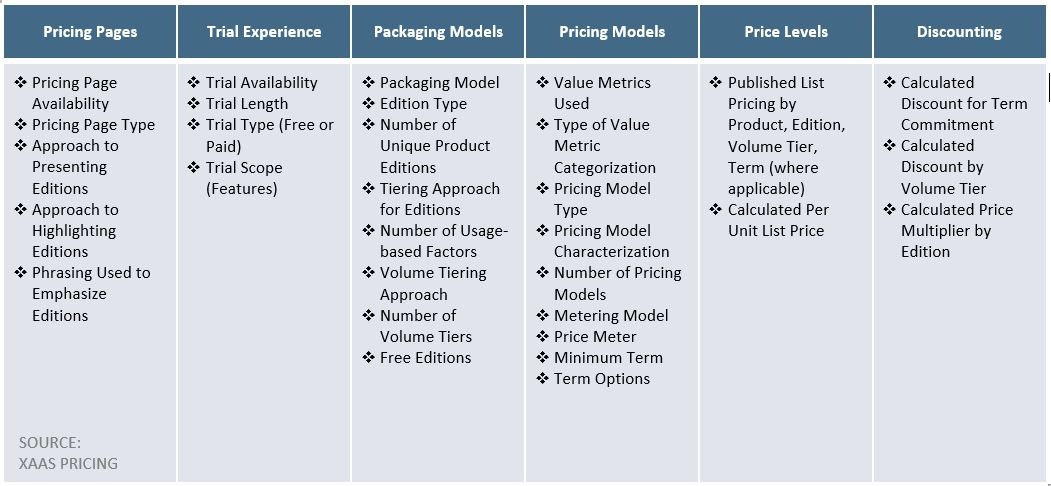

In the chart below we outline our final “version 1.0” metrics taxonomy. We believe it represents a solid starting point for a holistic, consistent 360-degree evaluation of competitors’ pricing strategies. We call this “version 1.0” because it’s a starting place, built largely off the types of data that are publicly available for most markets. In time, we plan to expand the metrics covered, particularly in areas like financial and operational metrics, deal sizes, customer types, and discounting. We recommend iterating on your own framework in a similar way, based on the data sources you have at your discretion. Building a competitive pricing assessment program around this framework or a similar one will help proactively address peer pricing questions and make your organization more focused around key pricing strategy needs.

©2022 XaaS Pricing. All rights reserved.

©2022 XaaS Pricing. All rights reserved.