Companies in the IaaS and PaaS markets will continue to set the course for how the entire tech ecosystem thinks about evolving to “as a Service” models

June 2022

Author: Bryan Belanger

June 2022

Author: Bryan Belanger

We spend a lot of time talking about IaaS and SaaS pricing strategies in our posts, and with good reason. The IaaS and PaaS markets are leading the technology industry shift to “as a Service” pricing, disrupting legacy categories and grabbing the attention of the investment ecosystem and the press. It’s all for good reason, too. Companies in the IaaS and PaaS markets will continue to set the course for how the entire tech ecosystem thinks about evolving to “as a Service” models.

But there’s a whole world beyond IaaS and SaaS. Many of our clients come from established, traditional technology sectors and are seeking to offer their products and services in an “as a Service” model. Many have made significant announcements and investments regarding their intentions to move swiftly to this model. Many of these players have significant financial resources at their disposal to make good on these bets and significantly disrupt the industry.

So, how is that shift to “as a Service” going for traditional technology providers? Where are we and what’s in front of us? Below we break down market and key trends in each major category.

If you’re interested in going deep on the PC and infrastructure hardware industry’s ongoing shift to Hardware as a Service (HWaaS), I highly recommend you check out TBR’s Hardware Subscription Services Market Landscape report. The team behind the report has been tracking that evolution for nearly a decade and has supported countless projects advising leading PC and data center hardware vendors on how to successfully navigate that transition. The report looks holistically at HWaaS across PC and all data center categories, covering major vendors’ strategies, portfolio developments and GTM activities.

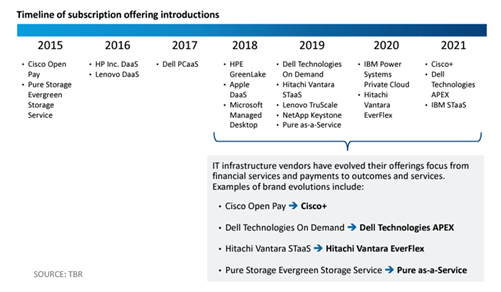

The HWaaS shift has been many years in the making. The report referenced above provides a helpful timeline of major product announcements in the space, seen in Figure 1.

Figure 1

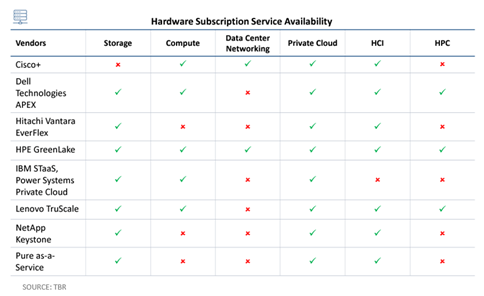

The information above proves that offerings for HWaaS have been in the market for many years. Portfolio maturity and service availability are deepest in storage, compute, private cloud and hyperconverged infrastructure (HCI), which is further outlined in Figure 2, also from TBR’s market landscape.

Figure 2

While offerings availability continues to expand, HWaaS has yet to take root as the primary consumption model for hardware. TBR estimates that hardware subscription services account for approximately 2% of total devices and infrastructure hardware revenues. While share is low relative to overall hardware revenues, TBR projects the HWaaS market will grow at a 41% CAGR through 2025.

Clear evidence of HWaaS’s slow pace of expansion can be found in vendors’ current approaches to pricing. One of the primary promises of HWaaS is an IaaS-like consumption experience, which includes transparent and public pricing, self-service digital commerce purchasing, and dynamic consumption metering to align to infrastructure requirements. The technology and portfolio offerings have evolved to meet this need, but commercial models trail.

PC as a Service (PCaaS) pricing is largely unpublished across the industry and requires engagement with vendors’ financing functions. Dell offers a PCaaS case study online, which provides a representative pricing example, but to access pricing for the full portfolio of PCaaS offerings customers must apply through Dell Financial Services. Other PCaaS vendors (e.g., Lenovo, HP Inc.) don’t offer this level of detail.

Things are a bit more transparent on the infrastructure side of hardware subscription services. Dell APEX, HPE GreenLake, NetApp Keystone and Pure Storage publish at least some form of packaging pricing for their XaaS offerings. Storage as a Service pricing is typically most transparent and fairly consistent across vendors. Dell APEX provides the most detailed pricing with its APEX pricing calculator, while others typically provide “starting at” list pricing. No vendors support self-service; all engagements require sign up and sales interaction.

Publishing pricing is a good first step, and the purchase experience is largely a derivative of the nature of HWaaS offerings. Many deals for XaaS offerings are large enterprise agreements that are custom scoped versus purchased off rate cards, so we can hardly fault these vendors for the approaches being used. But the stated ambition of the market is to compete with the IaaS players and in many cases packaging and pricing for HWaaS offerings has been designed to be competitive with Amazon Web Services (AWS) and other hyperscalers. The next step in the HWaaS’s pricing evolution will be to make pricing clear and standardized for rate-card-based offerings, and move toward a self-service consumption experience that is a hallmark of SaaS GTM and pricing strategy.

The telecom equipment industry is on a similar trajectory as the HWaaS market. Across the telecom network, including key functions such as the Core, RAN, IMS, infrastructure, orchestration layer and OSS/BSS, the focus of the industry is to move from traditional native and/or virtualized network functions (hardware-based and/or on-premises software-based) to cloud-native network functions. These are network functions that are built from the ground up as SaaS.

Like the HWaaS market, vendors are expanding portfolios in these areas and making cloud-native network functions available, but telecommunications services providers (e.g., AT&T) are lagging in their adoption of these network functions. This has created a downward drag on pricing and commercial models also; operators are still likely to purchase through traditional capex-based perpetual or multiyear term licenses, such that they can manage budgets for predictability and capitalize expenses.

There’s a major category of players in the game that will dictate the telecom industry’ evolution to XaaS — the cloud IaaS hyperscalers, namely AWS, Azure and Google Cloud Platform. TBR covers hyperscaler disruption in the telecom network extensively in its Hyperscaler Digital Ecosystems Market Landscape report. Telecom operators have many options for migrating to cloud, but ultimately their cloud strategy hinges on their approach to working with hyperscalers, which provide the foundational infrastructure. Telecom operators can standardize on a single hyperscaler, choose hyperscalers by software workload or geographic region, and/or a combination of these models.

Operators are still in their infancy when it comes to determining and standardizing on hyperscaler approaches and formulating those relationships. However, those relationships will materialize long-term and operators’ chosen approaches will determine how they purchase and consume network software that runs on top of hyperscaler clouds. Why? Because hyperscalers provide the backbone that all network software needs, and they are leveraging their position of power to disrupt the telecom network. Hyperscalers are also vertically integrating by acquiring leading network software providers, such as Microsoft’s purchases of Affirmed Networks and Metaswitch.

If hyperscalers define the future state of the cloud-ready telecom network, then they will also define how network functions are consumed. Once migration to hyperscaler clouds reaches critical mass, we believe commercial models will shift from traditional licensing to a higher instance of pay-as-you-go (PAYG) licensing. Hyperscalers have the commerce infrastructure in place via their cloud marketplaces, and TBR believes this will increasingly be the storefront for the telecom operator network.

Network functions will be purchased dynamically via hyperscaler marketplaces, with PAYG models defined by the hyperscaler, usually based on a price per compute hour for the software being used. This is not to say there will be no bring your own license models and certainly things like custom enterprise agreements will still be very much in play. But the market will move with the hyperscalers toward a marketplace-driven PAYG consumption model experience.

One of the most interesting yet under-discussed evolutions is the movement of the professional services industry to XaaS product offerings. There’s plenty of buzz around productized services, particularly in the startup ecosystem, but underneath that buzz is a raging undercurrent of major global IT professional services and consulting players that are seeking to not only productize services offerings but also, in many cases, shift their service-based businesses to SaaS.

TBR’s professional services team has written about this topic quite a bit, mostly through the lens of the steps that major services industry players are taking to ride the SaaS wave. One of my favorite pieces that the team has put together on the topic is about PwC’s Products division.

While PwC’s story of SaaS evolution is not unique to the firm, it’s a representative narrative for how this transformation is playing out across the services landscape. In the IT services ecosystem, for example, vendors that have traditionally served enterprises with low-cost, offshore-sourced ITO, BPO and applications services are seeking to productize service delivery assets into products. India-based IT services provider HCL Technologies (HCLT), for example, has released 450-plus products and the portfolio now comprises roughly 10% of the vendor’s top-line revenue. Similar strategies are being deployed by HCLT’s direct and indirect peers across the IT services landscape.

This model is also being deployed by management consultancies that have built their brand reputations and value propositions around delivering expensive and customized advisory services. The Big Four vendors as well as the MBB (McKinsey & Co., Boston Consulting Group and Bain & Co.) are acquiring and/or building software to sell directly to customers and/or embed in consulting engagements. McKinsey Solutions is a notable example, given the firm’s heritage in consulting as well as its traditionally acquisition-averse operating model. Another is Bain’s November 2021 acquisition of OPEXengine, a platform for SaaS industry financial and operational metrics benchmarking.

SaaS in professional services and consulting hasn’t yet unseated traditional services but it is becoming an increasingly important part of vendors’ portfolio strategies. Services vendors also have the advantage of being able to embed SaaS offerings into services engagements, providing built-in models for service-led growth of their XaaS businesses. We expect SaaS will continue to replace legacy services revenue streams across the professional services ecosystem.

Tracking competitive and market pricing strategy evolution in IaaS and SaaS categories isn’t easy, but in some ways it is straightforward. In most categories, baseline information on packaging and pricing is available publicly. And, as we’ve talked about in other posts, there are direct-from-customer resources available such as software review sites and Reddit that can help make sense of pricing strategies in these markets. Platforms such as Klue, Crayon and XaaS Pricing are providing on-demand tools to stay abreast of changes in peers’ packaging models, pricing models and price points.

The same can’t be said of HWaaS, Telecom as a Service and professional services. While some vendors in these markets are beginning to publish pricing, broadly speaking, there is much less publicly available information on peers’ pricing strategies. Commercial strategies are still being refined across these categories and their associated subcategories and contracting still largely occurs via traditional deal structures. This can make it difficult, time-consuming and expensive to examine the pricing strategies of peers and proxies in these markets.

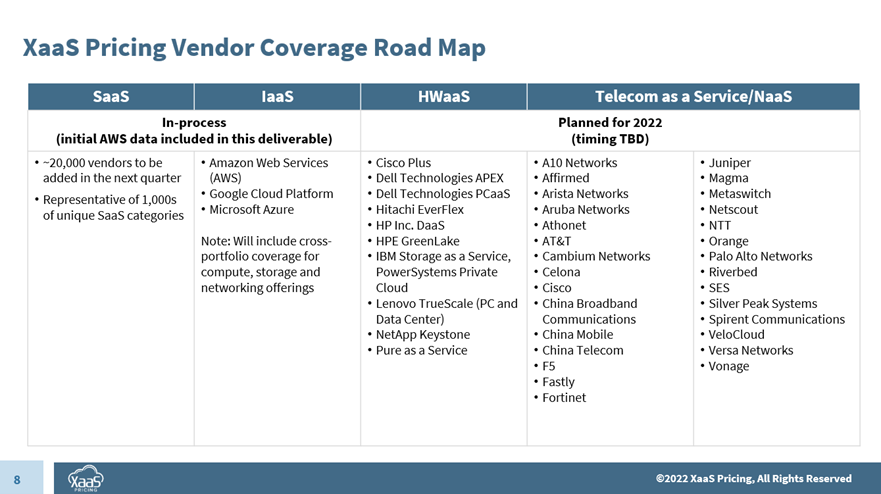

That’s where XaaS Pricing comes in. Over the next several months, in addition to continuing with the expansion of our SaaS and IaaS coverage, we’ll be adding publicly available pricing information for a select set of key players in the HWaaS and Telecom as a Service markets. Our planned coverage is outlined in Figure 3.

Figure 3

For those vendors that don’t currently publish pricing, we’ll be keeping them on our watch list and adding them as product announcements and/or pricing changes occur. We’ll also be diving deeper into actual pricing in these segments in our upcoming quarterly trends report. Become an Insider to receive that report when it publishes!

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

The most critical part of designing a SaaS pricing strategy

The most critical part of designing a SaaS pricing strategy