Usage-based pricing primer

Before digging into the fundamental question, it’s important to be clear on definitions for usage-based pricing. Everybody in SaaS seems to be talking about usage-based pricing (UBP) and product-led growth, and everyone is using a different definition.

For our purposes, usage-based pricing is a model in which customers pay for what they actually use or consume. Pricing is tied to a defined and clear usage metric, and customers are billed in arrears (usually monthly) for what they actually use.

A good example of usage-based pricing is any of your monthly utility bills. For example, my water company bills a fixed amount monthly per CCF used (one hundred cubic feet = 748 gallons).

In SaaS, usage-based pricing is one type of pricing model. The other primary SaaS pricing models that XaaS Pricing tracks are outlined below:

- Per user: Pricing is based on use by an individual; per-user pricing can include many variants such as per active user, per reader versus analytics user, monthly active users, agent, member, and many others.

- Flat fee: Pricing is based on a flat fee for a defined set of features and a defined amount of usage.

- Hybrid: A model that combines one or more of the pricing models outlined above. For example, a company may pay a recurring fee for a set amount of users for a particular plan, plus a usage-based fee for usage that exceeds the plan limits.

There’s an important distinction to be made here: Many analysts, agencies and venture capitalists (VCs) that track the state of usage-based pricing lump together two key usage-based pricing strategies — usage-based pricing (as described above) and usage-based tiers.

Usage-based tiers refers to a packaging model in which a subscription plan establishes set limits on the amount of utility a customer can gain from that plan. For example, Netflix specifies how many screens you can watch content on at the same time for a given account.

We believe it’s important to separate these models when considering usage-based pricing for your SaaS product. Usage-based pricing is a pricing model strategy, and usage-based tiering is a packaging model strategy. They are interrelated but separate strategic decisions that a vendor must make when considering how to deploy usage-based pricing.

We also believe it’s best to keep things simple. This site, for example, cites 12 examples of usage-based pricing. In practice, however, the examples given by that resource are a mix of packaging and pricing models, and all fit neatly into the four basic categories we’ve defined.

Usage-based pricing’s buzz factor and the current reality

Usage-based pricing got really hot in 2021, and this has continued into 2022. OpenView Partners, a VC firm and authority on all things usage-based pricing, has declared that “usage-based pricing is going mainstream.” The firm’s recent survey of 600 SaaS companies revealed that 45% of companies are using usage-based pricing and another 11% will start using usage-based pricing in 2022.

OpenView is certainly not wrong about the long-term trajectory and value of usage-based pricing. Its benchmarking data clearly shows that usage-based strategies are growing in popularity, and those that are doing it well are outperforming the market across key financial and operational metrics. Usage-based models help align pricing to customer value, offer built-in scalability, and allow for more dynamic adjustment to product packaging and pricing.

It’s tempting for executives to see these insights from OpenView and others, as well as the eye-popping valuations that leading usage-based pricing companies are getting, and think, “I need to have a usage-based pricing strategy for my SaaS.” However, it’s not as cut-and-dried as it seems on the surface.

Usage-based pricing comes with some significant potential challenges, the most obvious being revenue predictability and cash flow (for vendors) and expense predictability for customers. The latter typically becomes really important for enterprise IT departments needing to work within fixed budgets and can hinder usage-based pricing adoption at scale in larger accounts.

If you’re looking at all the market data out there and wondering where you might start with usage-based pricing, it’s best to consider the heralded benefits as well as the drawbacks. To help SaaS vendors start the process, we’ve created a usage-based pricing evaluation framework.

A framework for evaluating usage-based pricing

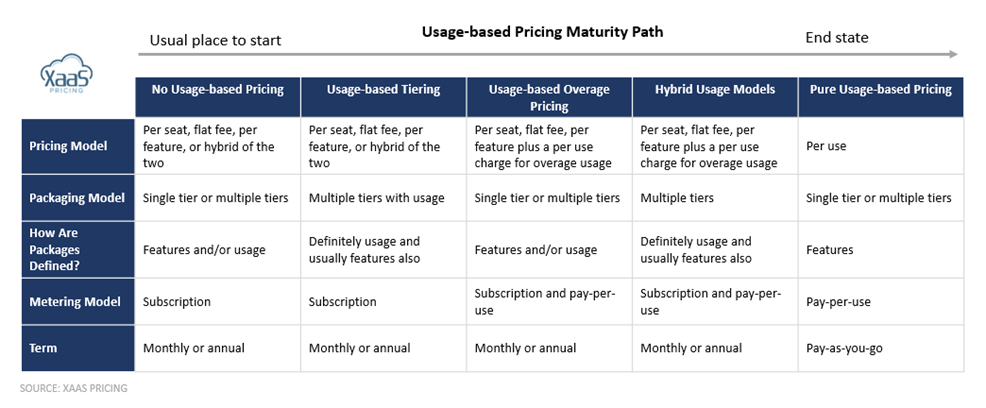

The first important thing to note when building a usage-based pricing framework is that usage-based pricing is a spectrum of strategy choices and a life cycle. This is baked into the OpenView data — the estimates include both pure usage-based pricing strategies and usage-based tiering strategies.

In XaaS Pricing’s recent study of approximately 130 high-growth B2B SaaS companies, we found that roughly 60% are still pricing their products based on a per-user model. Nearly three-quarters of these companies are integrating usage-based strategies through their tiering approach, or through overage pricing, instead of a pure usage-based pricing approach.

Every company can and should have a usage-based strategy. It comes down to which type of approach makes the most sense in context. The chosen usage-based strategy must align with a company’s product value proposition, go-to-market maturity, operational maturity and, most importantly, the needs and expectations of its target customers.

To help SaaS companies of all sizes determine the appropriate usage-based pricing strategy for their product and/or business, we created a chessboard framework to define different usage-based pricing pathways, outlined below:

©2022 XaaS Pricing. All rights reserved.

©2022 XaaS Pricing. All rights reserved.