Designing the competitive pricing research study

Once you have completed the exercise of context setting, you are likely ready to enter the next phase of research design. You and/or your team have likely also surfaced key elements of research design just in the process of setting context.

XaaS Pricing usually breaks down competitive pricing research design into three elements: Scope Design, Objectives Design and Methodology Design.

Scope Design

In Scope Design, the goal is to translate the research context into a specific research scope that can serve as your window into the problem being investigated. It’s easy to want it all in research — all potential competitors, all metrics, all scenarios, all regions. However, that is rarely practical, usually for budget and timeline reasons.

Scope Design involves narrowing to an achievable scope that can provide representative answers to the problem. Key elements to consider include:

- Direct competitors

- Proxy/broader market comps (do not discount these as valuable points of consideration)

- Product(s) and/or service(s)

- Product tiers

- Regions and/or countries

- Target customer(s) profile — size (headcount, revenue, spend and other factors)

- Customer context (greenfield versus renewal customers)

- Deal size and profile

- Route to market (self-service, enterprise sales, indirect by type of channel)

The best process is often to go through each of these characteristics and “design the dream house,” and then pare back to the right scope for the contextual constraints set for the research. Full consideration of these elements can help you think through priorities, trade-offs and goals — it is important that everything is on the table until it is pruned in iteration.

Objectives Design

Objectives Design goes hand in hand with Scope Design. This phase involves translating higher-level problem statements and context into tactical research questions that can be pursued in a bounded research effort.

The breadth of objectives as well as the depth of objectives will vary based on the overall nature of the guiding problem statements. Typical objectives to be considered include:

- Pricing models

- Price metering and terms

- Offerings packaging strategy

- Package content (features, usage conditions)

- Add-ons and attached services

- Volume tiering

- Typical deal sizing

- List price

- Sell pricing by term, deal size, customer relationship, customer context and other factors

- Discounting strategy

- Discounting bands and thresholds

Objectives Design usually involves determining which of these aspects matter (it can be few, many or all) and the details of the information needed for each objective. For example, the “discounting” objective may be about understanding a discounting strategy overall or about determining the typical annual discounts offered for customers of a certain size with one- or three-year term greenfield deals.

Methodology Design

Scope Design and Objectives Design help to define what scope and key tactical objectives a pricing study should cover. The next question is: How do we collect this data? That question involves consideration of the scope and objectives relative to the logistical constraints of the research.

We break down Methodology Design into two categories: Research Methods and Methodology Tactics.

Research Methods

Multiple Research Methods can apply to any given study; methodologies are not mutually exclusive and depend on scope, objectives and logistics. The typical methodologies outlined below are independent of sourcing method, meaning outcomes would be similar whether the research was executed by the vendor itself or by a research vendor or consultant working on behalf of the vendor.

- Secondary research: Gathering available public pricing data from vendor websites, channel partner websites, technology buyer review sites, social media and related forums, government schedules, blogs, industry and business publications, and other resources found via Google search

- Databases and platforms: Collecting competitive and/or market data from pricing data and analysis providers — Providers in this category vary in focus, depth and breadth of data as well as technology categories covered. Databases and platforms vendors may also provide custom research and/or advisory services to customize data. This category includes IT services benchmarking providers such as Avasant, ProBenchmark and XaaS Pricing.

- Software tools: Product analytics and user experience testing platforms that enable SaaS companies to embed microsurveys into their web applications — These types of surveys can be used to gather some pricing data in a survey-like format with a close-ended question provided via a pop-up window. Data is less complete than what is gathered via other research methods and is best used in conjunction with other methods outlined.

- Primary research: Fielding direct research with vendors, channel partners and/or customers to gather pricing intelligence from cross-functional pricing practitioners and decision makers — Primary research can take multiple forms depending on the focus of the project and the available budget and resources for primary research. Types of primary research include:

- Win/loss research: Conducting win/loss interviews with recently converted customers and lost prospects (typically within 90 days) to understand decision-making behavior and the relative value and positioning of pricing as part of a broader set of decision criteria — Win/loss is focused on validating and quantifying the reasons a vendor wins or loses deals for a given customer profile. This type of research can also include analysis of CRM data.

- Sales-sourced customer research: Internal interviews with sellers and/or direct sourcing of primary pricing intelligence from a vendor’s sales organization — This can often include listening to and analyzing sales call recordings from platforms such as Gong, Chorus.ai, Outreach or other similar tools for insights on pricing and packaging.

- Vendor, channel and/or customer interviews: In-depth virtual or in-person qualitative interviews, typically 30 minutes to one hour in length, targeting vendors, channel partners and/or purchase decision makers at customers, depending on the agent fielding the interviews — Interviews are comparable to the methods used in win/loss research but are structured more broadly. Win/loss is one type of interview-based qualitative research method that can be utilized. Interviews can cover a variety of questions and topics related to packaging, pricing models, price points and discounting. Interviews typically target a smaller sample of highly qualified respondents. The number of interviews fielded depends on multiple factors, but we typically recommend a minimum of three to five per segment analyzed. Prevailing studies on qualitative research suggest interview outputs reach saturation (i.e., incremental respondents repeat themes and do not share additive insights) after approximately 10 to 20 interviews. Interviews can be sourced from internal channel and/or customer contacts, or by working with an expert network provider, such as GLG, or another qualitative research company.

- Survey research: An online-fielded survey of channel partners and/or customers — Online surveys are typically programmed using Qualtrics or another survey hosting and management platform. Surveys average 20 to 30 minutes in length, covering largely close-ended questions plus a limited number of open-ended qualitative questions. Survey respondents can be sourced from internal channel partner and/or customer contacts or via a survey panel provider such as Dynata. Survey sampling can vary widely based on the type of survey research. A typical minimum viable survey sample that we like to target per end segment is 30 to 50 responses. For example, if we were surveying 1,000 to 5,000 employee manufacturing firms in the U.S. as a segment, our goal would be 30 to 50 responses from IT decision makers in that segment. However, this can vary widely based on the sample sourcing required to support the chosen survey methodology. An appropriate approach is to determine the level of statistical validation required for a survey study, and where applicable, conduct a population analysis to determine an appropriate survey sample requirement. This must also be weighed against the practical considerations of feasibility to access the target survey audience for a given study. Common survey methods used in primary pricing research include Van Westendorp Sensitivity Analysis, Conjoint Analysis and Discrete Choice.

Methodology Tactics

In our many years fielding competitive pricing research, we’ve had many major wins along with our fair share of research challenges. Through this journey, we’ve developed and honed several tactics that help us optimize the types of pricing research results that we achieve. We will explore these tactics in greater detail in future posts, but we’ve summarized a few tactics below:

- Apples-to-apples rules in all research design: Every deal and every customer is different. Research approaches that focus on trying to normalize individual customer deals for pricing analysis often fall short for this reason. We structure our research around definitional constructs and a set of manageable (three to five maximum), predefined configurations, allowing us to normalize the analysis up front, instead of having to shoehorn like-for-like comparisons out of noncomparable data. Areas to define up front include the offerings and/or bundles that are apples-to-apples, the deal scenarios to analyze and the specifics of those scenarios (i.e., customer type, deal size, renewal or greenfield deal, terms).

- Comparing strategy is often more valuable than comparing price: For the above reasons, we often find that most of the “aha!” moments in research come from analysis of pricing strategy and process elements. While a competitor or market price can fluctuate in any scenario, the pricing model that a competitor uses does not. Similarly, the discounting governance process and escalations for different deal sizes are likely more rigid than the bid price on one customer’s deal. Understanding these strategy indicators in research can help vendors become more predictive about their peers and the market, helping them create an overall better pricing proposition.

- The story is more important than the data: The narratives on “why” are much more impactful, particularly in presentation settings, than the pricing data itself. It’s nice to know that we are priced 10% below or 10% above market, but it’s more valuable to know why that is and what that means for customer value and decision making. For these reasons, we tend to use interview-based research more frequently than survey-based research in our projects. Interviews facilitate a minimum viable level of pricing data capture, while also fostering the back-and-forth human conversations that generate impactful qualitative insights.

- Go off script: If you’re using an interview-based approach, one of the major values is that the interviewer can take the conversation off script and onto an even more valuable path if the discussion merits. We’ve seen it repeatedly — a vendor wants to do pricing research because it is losing deals and customers are telling the vendor it’s about pricing. When we start interviewing customers of that vendor and its competitors, we learn the root of the issue is much deeper. Maybe the sales process creates too much friction, the pricing model is too complex or the vendor has a high-cost operating model that cannot support market pricing. These types of insights usually only surface through a live interview conversation that can “follow the shiny object” that is surfaced by the respondent.

- Let stakeholders into the process: It has been proven through numerous scientific studies that the human mind processes narratives much better than data. When presenting research results, use customer quotes liberally to support the delivery of executive messages. If you are sourcing insights from recorded sales calls, embed key video snippets directly into a presentation. Giving those consuming the pricing analysis a window into the process, and the conversations that supported the results, is a great way to build buy-in and trigger emotions. Another element is to approach a pricing research effort as an iterative process, not a one-time effort. Drip outputs to leadership and other stakeholders frequently via email, Slack or short presentations. Do not wait until the end of the research to start working on the conclusions. Enact pricing experiments in an agile manner while conducting the research, and be open to changing research questions or objectives in response to learnings along the way.

- Lean on your friends in the government and/or channel: If you are stuck in sourcing, try finding a General Services Administration schedule, check Gov.UK, or search Amazon Web Services, Microsoft Azure or Google Cloud Marketplace. These sources tend to be a wealth of information on pricing. While the actual quantitative price point (if available) may be of little use in your research context, you will likely find insights on packaging models, pricing models and subscription terms that will be applicable to your analysis. These sites often will have terms of services or licensing agreement documents that can provide even greater insight into these topics.

Bringing it all together

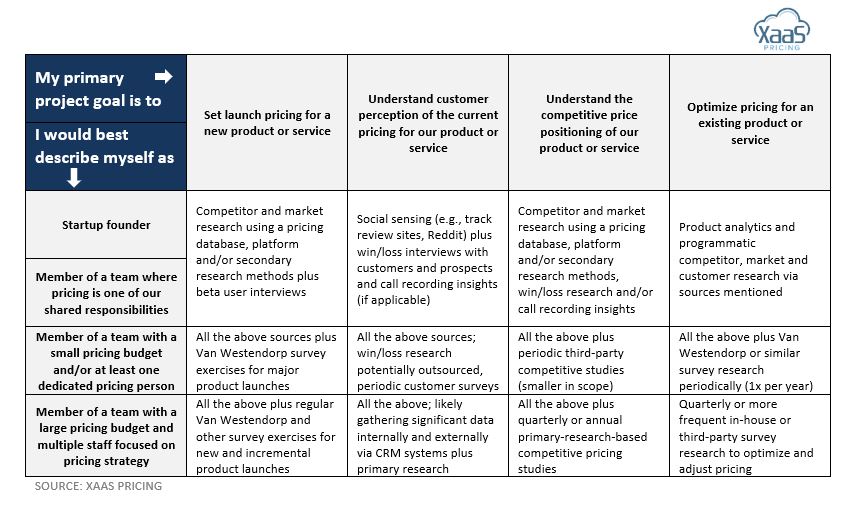

There’s a lot to digest about pricing research structure and methods, and even more to say on each topic in this guide. Below is a simple framework to help you get started. These are our recommendations on types of research and methods to focus on based on key pricing goals and likely budget and resources available for research based on team size and stage. We’ll be writing much more on this topic and the subtopics listed above so stay tuned!

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

The definitive SaaS pricing models guide

The definitive SaaS pricing models guide